Helping You Be Prepared

As part of the Duquesne family, eligible faculty and staff members enjoy comprehensive benefits that help you take care of yourself and your family. These include medical, dental, flexible spending counts, life insurance and long-term disability.

You can support your physical, mental and financial health by taking advantage of our on-campus workout facility, wellness programs and tuition benefits. We also care about your future—as an employee, you'll be immediately 100% vested into a retirement plan.

Be Prepared: 2024-2025 Open Enrollment

2024-2025 Benefits Overview Guide

- Open Enrollment takes place Monday, May 13 - Friday, May 24, 2024.

- Benefits Fair | Wednesday, May 15, 2024 | Power Center Ballroom | 10 a.m. to 3 p.m.

- Current employees may log in to make Open Enrollment elections or update benefit preferences and review current benefit plans in the 2023-2024 overview guide.

We're here to help you understand changes and improvements to our benefits offerings.

Learn about these new features, and all of our benefit plan options, at the Benefits

Fair on May 15. Duquesne University is committed to employee financial well-being, offering a retirement

plan that helps employees prepare for and build long-term financial security. The Roth 403(b) is a part of the University's retirement plan and provides eligible

employees with an option to make voluntary contributions on an after-tax basis. What is a 457(b) plan? The University also offers a 457(b) Retirement plan for eligible employees. This plan

is a non-qualified, tax advantaged, deferred compensation retirement plan that is

used to provide an additional opportunity for pre-tax contributions for eligible employees. Department of Labor regulations require the University to provide detailed information

about investment options and expenses associated with these investments.New Improvements: Make the Most of Your Benefits

Covered illnesses include:

Plan Features and potential payout:

United Concordia offers a nationwide network that makes it easy to find an in-network

dentist.

Learn more about your dental plans, and find an in-network dentist, by visiting United Concordia's dedicated Duquesne University Corner.

Where do I get my medication?

Use your resources to help save on prescription drug costs.

Take time out to get to know your prescription benefits.

To assist employees in providing these types of protections the University offers

term life insurance and accidental death and dismemberment coverage at no cost to

eligible employees.

The University also offers supplemental life insurance for yourself, your spouse and eligible children. During open enrollment, you may

elect additional coverage up to the guaranteed issue amount without providing evidence

of insurability (health condition information).

The University has partnered with Highmark, UPMC and The Center for Pharmacy Care

to offer this program.

Members can earn Wellness in Motion Dollars for each wellness activity that is completed.

Highmark PPO members receive Wellness in Motion Dollars in a health reimbursement

account (HRA). Dollars in this account are automatically applied to medical deductibles

and co-insurance.

UPMC EPO members receive Wellness in Motion Dollars on on UPMC Consumer Advantage

debit card. Participating members will receive this card shortly after the start

of the plan year. This card can be used for services that go toward the deductible

and co-insurance.

Employees and their participating spouse can each earn up to $300 in Wellness in Motion

Dollars.

Check-out the Duquesene University portal for more detail.Retirement Plan

Duquesne University's Match Contribution

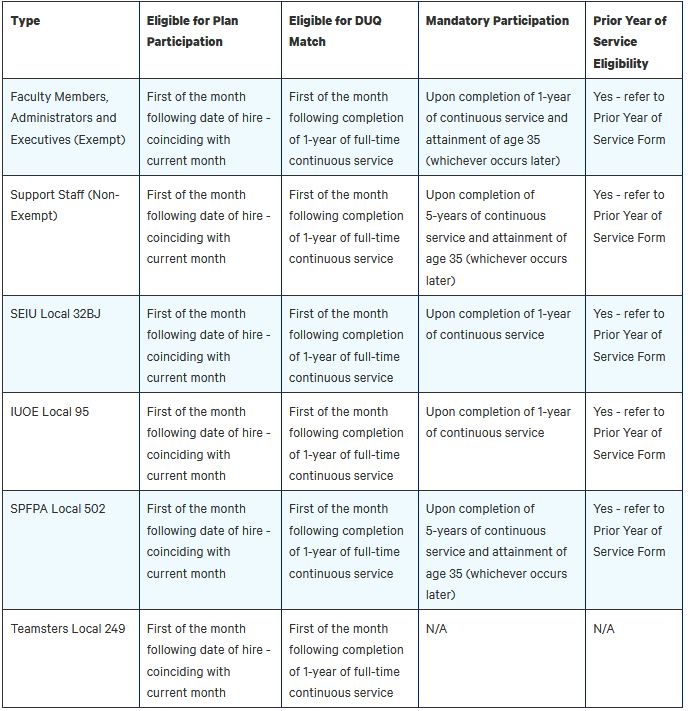

The University offers a match. Eligibility for the match is based on employment status

as outlined in the chart below.

Retirement Eligibility

Log In or Enroll in Retirement Plan

Yes, the Duquesne University plan will accept rollovers from other pre-tax sources.

What is the maximum amount that I can contribute?

Federal tax law limits the amount you can contribute. The limit for calendar year

2023 is $22,500 with an additional $7,500 catch-up for those age 50 and above.

Are the any other voluntary contribution options?

Yes, employees have the ability to contribute their own money to a University sponsored

Roth 403(b) Plan. Eligible employees have he option of electing after-tax contributions

through payroll deductions into the Roth 403(b) voluntary contribution option under

the Duquesne University 403(b) Defined Contribution Retirement Plan.

Are there any loan features associated with the Duquesne University Retirement Plan?

Yes, employees may take a maximum of two loans based on all accumulations.

The salary threshold to participate in this plan must meet the IRS definition of a

highly compensated individual. For 2024 the IRS definition of a highly compensated

individual is $155,000.

For more information about this plan please reach out to the Benefits Office or a

TIAA financial advisor at 800-732-8353.

Qualified Default Investment Alternative (QDIA) Initial Notice

Summary Annual Report

2021 Duquesne University 403(b) Retirement Plan Summary Annual Report

Summary Plan Description

Duquesne University 403(b) Defined Contribution Retirement Plan Summary Plan Description

Universal Availability

Duquesne University 403(b) Retirement Plan Universal Availability

Plan and Investment Notices

TIAA Plan and Investment Notice

Valic Plan and Investment Notice

The disclosure gives plan participants a complete picture of all the funds and associated

expenses available. The disclosure is for informational purposes only.

The information includes: